Are Retentions Hurting Construction Subcontractors?

This is a remora. If you’ve ever seen a nature documentary about sharks or whales, then chances are you’ve seen one of these fish before. They’re the guys that stick to their bigger companions, hitching a ride around the ocean with them. They’re the ones that ‘clean’ the bigger fish, eating lice and clearing parasites from their skin. Basically, they do the jobs that their host can’t, or doesn’t want to do in exchange for a free ride, which is necessary as they aren’t the best swimmers themselves.

In construction terms, subcontractors are remoras. They’ll do work on behalf of, and ultimately get paid by, the main contractor. However, unlike the remora/whale relationship, the payment for their work can be a little more complicated, namely through the concept of retentions.

Retentions are security mechanisms used by main contractors to ensure subcontractors fix non-compliant works, a financial safety net for the larger company to protect against bad practice.

Cash retentions take the form of cash deductions from the subcontractor, held by the main contractor, as a security to ensure work is carried out in compliance with the agreed contract. This retained cash then tends to be split: one half being retained until completion of the works, the second until the expiration of a liability period after the subcontractor’s works are then subject to inspection. If the subcontractor’s work fails to meet the necessary standard, the monies are retained until the subcontractor completes the repairs.

This is all to protect the main contractor against unscrupulous subcontractors, forcing them to remember to dot their I’s and cross their T’s.

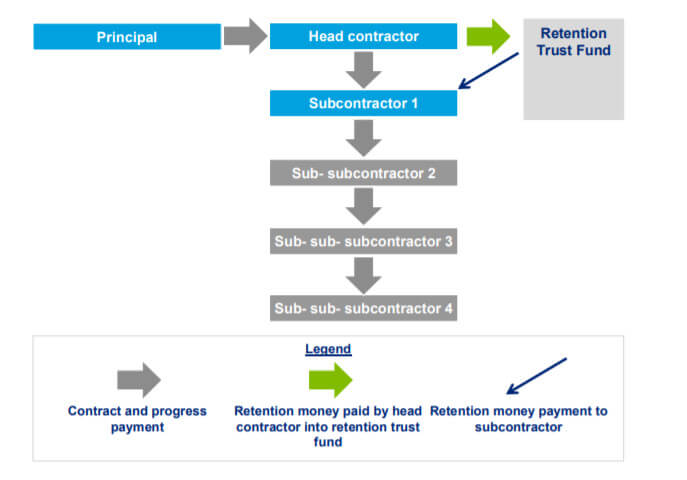

Source: Deloitte

In theory, this is a great system if everyone involved holds up their end of the agreement. If not, then this can leave the (often significantly smaller) subcontractors left to the mercy of the larger business.

25% of SMEs in the UK claim that a loss of £20,000 or less is enough to jeopardise business prospects, and over a three-year period, over £7bn worth of retentions were outstanding within the construction sector. This can be due to main contractors delaying payments or failing to repay altogether. Often subcontractors chalk these outstanding payments up as losses, due to a lack of administrative capabilities (Dept. for Business and Innovation).

Another major concern for subcontractors is main contractor insolvency. Over the last three years, SME’s have lost £700m in retention due to insolvencies, as the cash held is regarded as capital and taken by creditors upon liquidation of the main contractor (Dept. for Business and Innovation). In this situation, the subcontractors are hit with both a loss of future business and a loss of the retentions owed.

Carillion’s liquidation announcement serves as a reminder that even huge multi-national contractors aren’t too big to fail. The expected job losses and the uncertainty of the pension schemes are sure to have a profound effect on thousands nationwide. However, what is yet to come to light is how Carillion’s application for compulsory liquidation will affect numerous subcontractors in the UK. How much was held in retentions by the company? Will these monies be considered by creditors as part of Carillion’s assets and cash? What will happen to the countless smaller businesses that are uncertain about the security of their retentions? Larger companies are often able to borrow against the size of their brand in times of uncertainty, a luxury which isn’t afforded to smaller companies.

While it may be too late for those associated with Carillion, in future the system of retentions could be about to change, with cause for country-wide celebrations amongst remoras and subcontractors alike.

Countries such as the US, Australia and NZ already require retention money to be ring fenced and held separately, so it’s not counted as capital by creditors upon the declaration of insolvency. An example of this style of ringfencing is a Retention Trust Fund; whereby the money paid for the retention is held in a separate trust account, quarantined from the main contractor’s operating budget. The Scottish government, for example, have implemented a system which ensure timely payment for subcontractors on all government projects, which could be extended to retentions.

Source: Deloitte

In the UK, after a consultation period which ends on the 19th of January, the first reading of a bill aiming to protect subcontractors regarding cash retention is taking place. The bill aims to protect subcontractors from both upstream insolvencies and malpractice. If approved, the bill will enable SME subcontractors to be able to take and complete work without having to prepare for the possibility of not being paid. In turn, that capital can be reinvested by SME’s to hire apprentices and upskill previously unskilled workers, creating a new, younger labour force.

Without the threat of non-payment, the protection of retention money can also allow for reinvestment in modern technologies, enabling them to take on more work, accommodating further growth and expansion.

Luckily, remoras don’t have to worry about retentions, rebate periods and inspections of their work, and 2018 could be the year that the creases are ironed out of the system, enabling SMEs within the construction sector to plan for growth and expansion this year and beyond.

Recommended.

Overcoming Automation Roadblocks for Unprecedented Success.

With significant barriers to automation onboarding for warehouses across the industry, how can we navigate these challenges for better success? I spoke with Jeff Christensen to explore the trends and businesses to know right now.

Construction Technology Advancements Leading the Way.

Advancements in the construction technology space are changing the future of the sector. What can we learn from new product offers from company leaders? Click to find out.

Smart Technology & Talent Retention in Access Control: An Interview with Lee Odess.

Smart tech has allowed the security and access control space to evolve greatly in recent years. I spoke with industry leader, Lee Odess, about what the future may hold for the space.

.png)

Your Building Is Under Attack, Are You Prepared?

In the final episode of this series, Lewis speaks with Don and Veronica from 5Q, a key leader in technology, innovation and real estate operations. They discuss key takeaways from this year's Realcomm event and loads more. Click to listen now.

Comments.