Time to Double Down on Cargo.

Heading into 2020, there was an equilibrium in rates for air freight. Balance had been somewhat achieved, with capacity to rate stabilising. Then a global pandemic hit...

Air cargo rates soared to $100+ per kg, with COVID-19 causing thousands of passenger planes to be grounded and belly space capacity to be reduced by 90% almost overnight. As a result, this increased the demand for charter flights - especially in the cold chain where time critical delivery is crucial.

To secure capacity at stable rates on the main lanes, several forwarders established charters. Examples include:

- DHL announced a twice-weekly 747 service running from China – Amsterdam – Chicago – Seoul – China aimed at the pharmaceutical sector

- DSV added two 747 freighters on the Europe-Asia lane, adding 1400 tonnes of capacity a month between their shanghai and Luxembourg hubs

- DB Schenker run 10 full charters per week out of China (Beijing, Shanghai, Zhengzhou, and Hong Kong) to Chicago and Frankfurt

- Geodis deployed two permanent weekly freighter services on Asia-Europe coming out of Shanghai and Amsterdam

- Dachser commenced weekly services from North America to Europe (Frankfurt and Chicago)

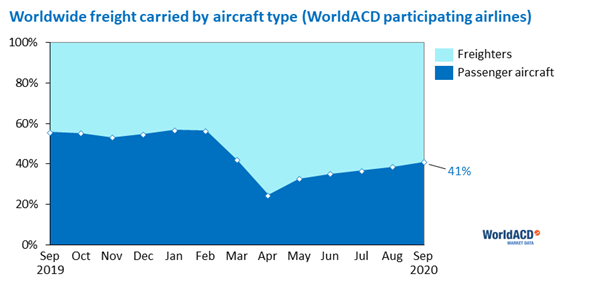

Many passenger flights are still grounded, meaning cargo divisions of airlines - which have played second fiddle to their passenger counterparts for years - are the key money makers for their respective groups. Now is the time to double down on cargo.

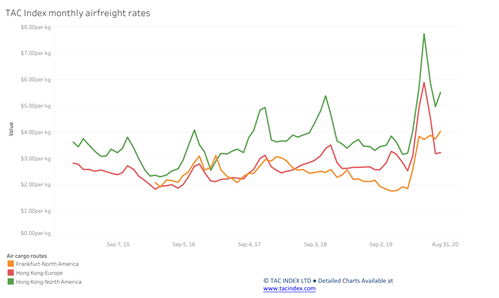

Between April and September, airline cargo revenues increased 42%. Yields/charges per kg increased by 81% from an average of USD 1.75 to USD 3.18 and the largest year on year (YoY) differences were recorded in yields/charges ex-MESA (+112%) and ex-Asia Pacific (+108%).

All-cargo airlines such as FedEx, UPS, Atlas Air and Cargolux have benefitted the most. There’s been strong demand for their services, especially from the cold chain customers where a fully controlled environment is crucial.

FedEx and UPS have also had their core market demand increase alongside eCommerce and consumer demand, with lockdowns around the world adjusting shopping habits.

With carriers adding capacity, we’re seeing rates rise with current lanes at an average of $8 per kg on the Asia-US lane and $5 per kg on the Asia-Europe lane.

On smaller lanes, yields/charges went up to levels between 8 USD and 9.5 USD. Meanwhile, on the larger lanes, the average yield was nowhere near the incidental yields reported by some over the past months: Asia Pacific noted an average of USD 4.89 to Europe and of EUR 5.91 to North America.

This is higher than Q4 19’ figures, but with peak season on the way and a number of large consumer electronics being released this year, notably Apple and Sony, this is going to continue to rise. Any such rise could prompt carriers to deploy passenger planes to bring more capacity into the network.

More charters are likely to be set up too, as forwarders look to secure capacity as soon as possible. This is especially likely when moving into a period of volatility in the Q4 market. Securing the space now should avoid rocketing rates and minimise disruption to global supply chains.

A Stabilising Market

September 2020 marked the end of the first two ‘COVID-19 quarters’. The month itself seemed to bring some reason for optimism, as the YoY drop in kilograms worldwide was by far the lowest since April: -12.5% for September against -33% for April.

The situation has stabilised month on month too, with a 7% increase meaning that September provided similar result to August. Even yields/charges per kilogram seemed to stabilise around USD 2.82 (still over 60% higher YoY).

The numbers suggest that air cargo is in the best shape it’s been in since April 2020, when the global impact of COVID-19 started to take shape.

However, there's still a lot of volatility and uncertainty, so we can't get ahead of ourselves.

With the recent Covid-19 vaccine announcement and hopefully many more to follow, it is likely that vaccines will be distributed via near-shoring and the ground PAX fleet will be activated in order to manage transportation. There there is also an expectation that this will not extraordinarily affect airfreight demand. We may see also see in the 2nd half of 2021 that PAX capacity will start to return which will also impact on yields.

If you’re a professional in this market and you’d like to share your opinions on this article, please email me at Aaron.Pearce@industrial-cm.com.

You can find more of my content about logistics via my consultant page.

Recommended.

Promising Heights: Drone Tech Offers Exciting Expansion Opportunities.

The use of drone technology remains minimal across industries, so what are the barriers to drone onboarding and what can they offer us? Let's discuss.

How Can RaaS Open the Door to Warehouse Automation?

RaaS could be the secret weapon in reaping the benefits of warehouse automation with none of the hassle, here's how...

Is the UK Ready for Warehouse Automation?

Sameer Jaffary analyses the advancement of warehouse technology including the impact of Brexit and the Coronavirus pandemic. Click to read.

The Rise of Warehouse Automation.

This past year has seen a huge boost in e-commerce activity across the globe. To keep up with such demands, there's been an accelerated rate of automation adopted within warehouses and distribution centres.

Comments.